Financing

Welding Equipment and Industrial Supplies Financing

Welding Mart has partnered with Clicklease to provide industry-leading welding equipment for a low monthly payment customized to fit your budget. Our welder financing services allow professionals to outfit their shop with the right welding machines and systems to serve customers. Whether you need a new MIG welder, a rental TIG welder, a virtual welding training simulator or something else, rent-to-own welders from leading brands such as Lincoln Electric and Miller are a great solution.

It's never been easier to afford the equipment you need to grow your business.

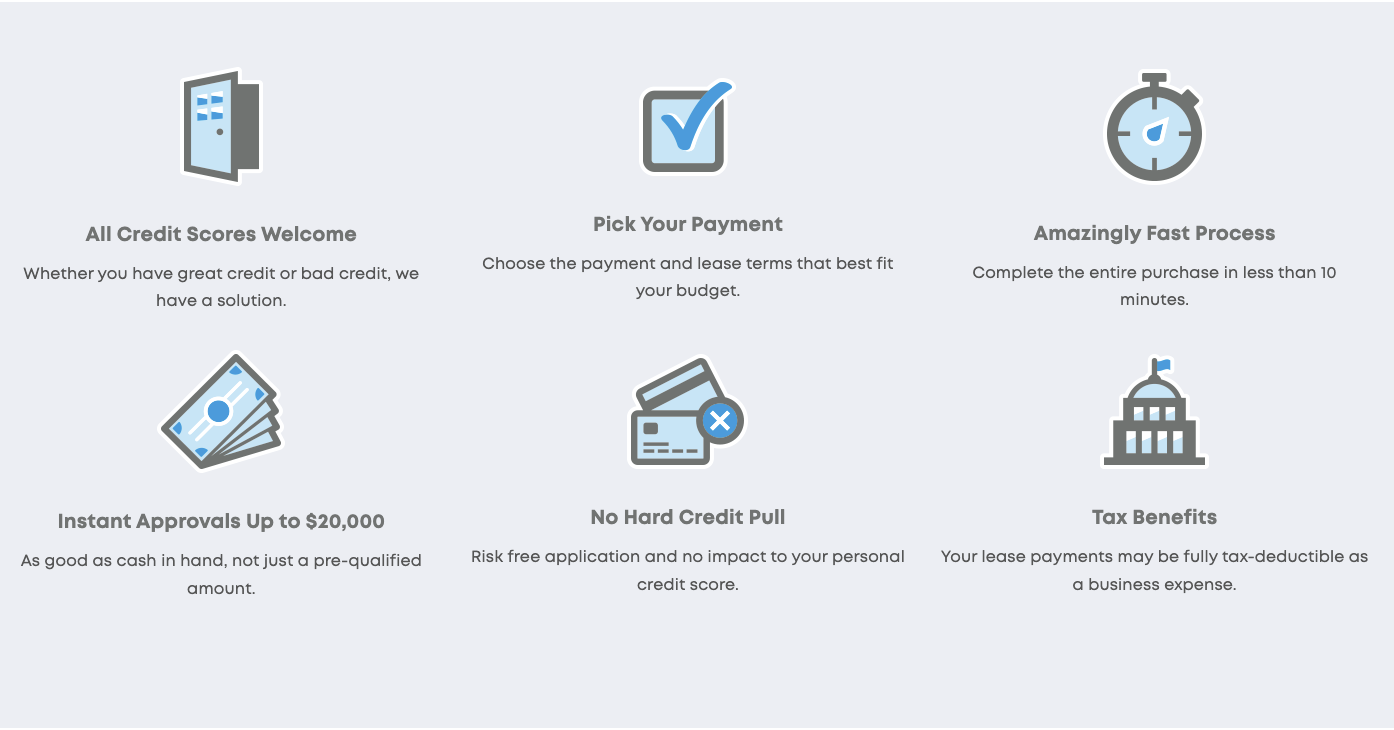

Apply in just four minutes and get real approval in seconds - there's no hard credit pull and no documents are needed.

Benefits of Lease-to-Own Welders

A welding machine rental is great for short-term and long-term business needs. Welder leases and rentals let companies stay on top of the latest welding technology without draining their operating budget by paying upfront, in full for new machines. At the end of the lease period, you can either purchase the welding equipment outright or return it to WeldingMart. You can also buy the equipment anytime within the first year of your lease - see below for more details.

Welder rentals can also have tax benefits. In many cases, the payments you make when you lease or finance a welding machine for business or educational purposes are tax-deductible. This frees up even more resources to get the equipment, supplies and personnel that welding businesses need.

More Information

More Information

Welding machine financing is available 24/7 so you can apply whenever it's convenient for you. It will only take about four minutes of your time.

Once approved, you'll have the option to select the term that best fits your budget and, if approved for more than you request, our calculator makes it easy to see how your payments change for any additional items you add to your lease. eDocs are available immediately, allowing you to order your new gear within minutes.

Have additional questions? Contact us to speak with a member of the WeldingMart team.

Free Shipping on all Lincoln Electric Orders Over $75

Free Shipping on all Lincoln Electric Orders Over $75